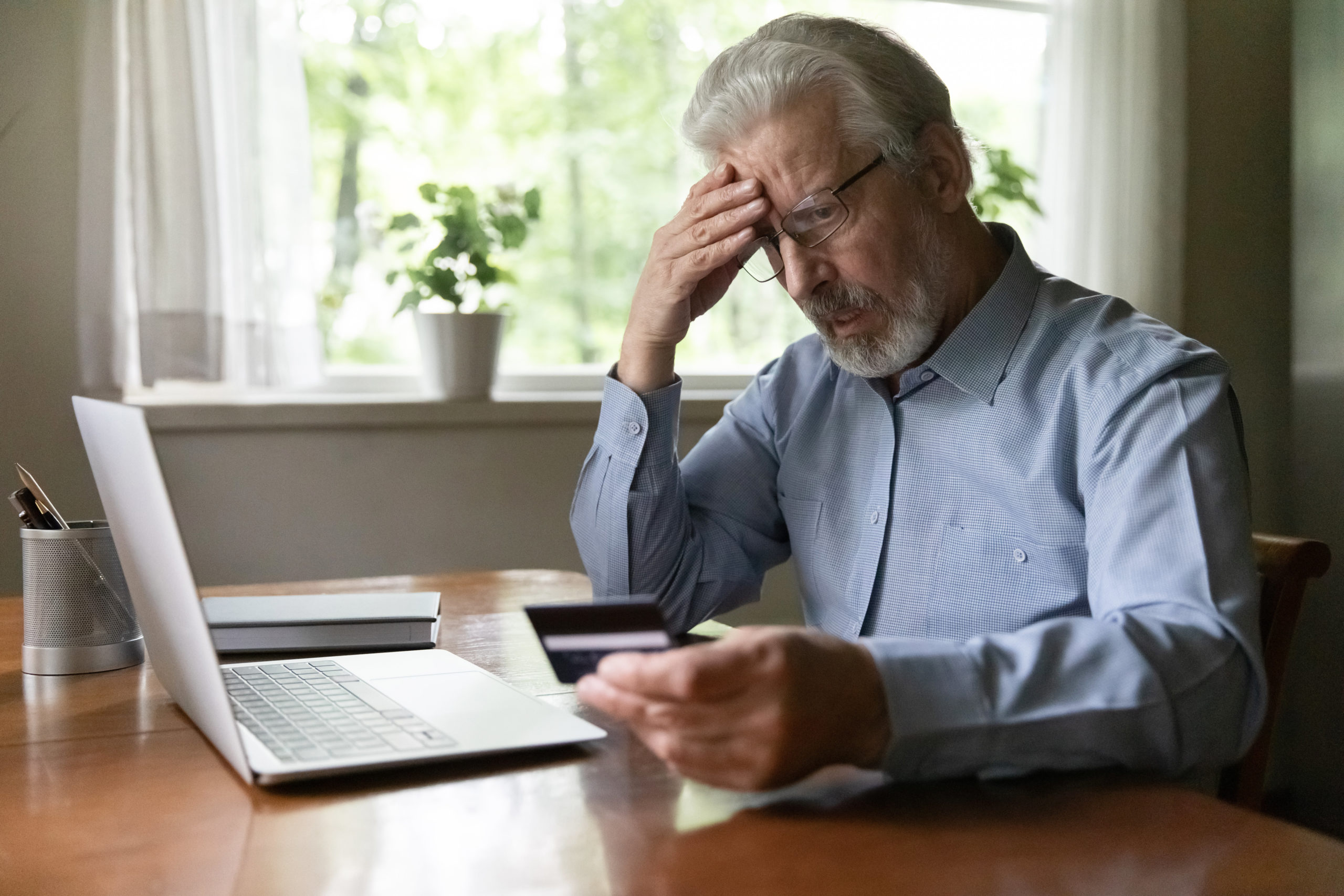

According to an FBI report released last week, seniors lost almost $1 billion in scams in 2020.

Many people believe they can outsmart a scam. But millions of Americans become victims each year —and it’s not because they’re dumb. Con artists are master manipulators who prey on the most vulnerable, the elder demographic, attempting to win their trust. Trust that is then weaponized for financial gain.

Thanks to advancements in technology, scams are becoming more convincing and harder to recognize. The online world has become a virtual playground for criminals looking to cash in on inexperienced users, with seniors being a primary target.

Although anyone is susceptible to becoming a victim, populations aged 60+ have more to lose, spending years accumulating wealth, valuable possessions, and retirement savings, thus contributing to the growing number of elder fraud cases seen over the last few years.

ETHOS understands the devastating impact fraud has on its victims. Learn more about these 8 common senior scams to reduce your risk of becoming a victim.

1. Fake Product Scams

Amid the pandemic, a surge of fraudulent ads started popping up across social media and e-commerce sites, resulting in $40 million in losses last year. Non-Payment scams are the second most reported fraud among seniors.

Online shopping lets consumers tap into a sprawling global market littered with counterfeit products disguised as recognizable brands. Cosmetic products account for many fraudulent items, selling on sites like Amazon and containing toxic ingredients that pose serious health effects. Many victims who purchased items through links advertised on social media reported receiving nothing at all or receiving something different than advertised.

2. Tech Fraud

Tech Support Fraud is the third most reported fraud, with seniors reporting losses of $116 million last year.

This scheme involves the criminal posing as a customer service representative for financial institutions, utility companies, or popular online retail chains, with scammers targeting their victims in the following ways:

- Telephone: Scammers call their victims pretending to be computer support, bank representatives/support, and utility companies.

- Search Engine Advertising: Criminals pay for their fraudulent company’s link to show up higher in online search results, increasing the likelihood of reaching potential victims.

- Pop-up message: An automated message appears alerting the victim that a virus has infected their computer, prompting them to contact the fraudulent tech support company using the number provided.

- Email: An email warns users that their support subscription is about to expire or notifies them of a potentially fraudulent charge on their account. The victim needs to call the fraudulent tech company to resolve the issue.

3. Email Lottery Scam

In 2020, the IC3 received over 3,700 reports of elderly victims in lottery and sweepstakes scams. Victims lost over $38 million to these types of fraud. The email lottery scam involves the victim receiving a call, email, or piece of physical mail congratulating them for winning a contest or lottery they never entered in. Before claiming their prize, victims must first pay taxes or fees through wire transfer and provide banking information to have their winnings deposited.

4. Romance Scams

According to the FBI, romance scams result in the highest amount of financial losses compared to any other type of online fraud. Subjects trick romantic hopefuls by using a fictitious online identity to gain the attention and affection of their victims. The global pandemic offers scammers creative new ways to play on their victims’ heartstrings. Schemers share distressing tales of current health problems or current job loss to gain sympathy to exploit for financial gain.

In 2020, the IC3 received complaints from 6,817 elderly victims who experienced over $281 million in losses.

5. Social Security Scams

In these cases, the victim receives a phone call from a criminal disguised as a social security agent. The phony agent informs the victim that their social security number has been linked to a crime, typically related to drug trafficking or illegal money wiring outside the country. The criminal creates urgency by informing the victim that their SSA number has been blocked. The agent then offers to help reactivate it— but needs you to confirm your social security number.

Last year, seniors reported losing $46 million to this type of fraud. With advancements in technology, scammers now have access to tools that allow them to display the SSA’s phone number on their targets Caller IDs (1-800-772-1213).

6. Grandparent Scam

In this type of elder fraud, an imposter pretends to be the victim’s grandchild. The con artist tells worried grandparents that they’ve been in a car wreck or sitting in prison and need immediate financial assistance to deal with the emergency. This scheme operates so seamlessly because scammers manipulate their victims into staying silent about the incident, reducing their chances of getting caught.

During a 2019 Aging Committee hearing, a Pennsylvania witness recounted her parent’s experience of losing over $80,000 after a scammer convinced them that their grandson was in jail.

If a family member contacts you and claims to be in trouble with the law or needs financial assistance, call their number or verify with other family members before sending money to help.

7. IRS Impostor Scam

IRS Scams are sophisticated phone scams directed at taxpayers. Fraudsters dupe victims into believing they’re official IRS employees by providing a fake identity and phony IRS identification badge number. Victims are informed of an outstanding debt owed to the IRS that requires prompt payment. Individuals who refuse to cooperate are met with arrest or deportation threats.

8. COVID Scams

From stimulus payments to bogus COVID cures and remedies, the global pandemic has created a new market for schemers looking to cash in.

In June 2021, the FTC reported over half a million consumer complaints regarding COVID-19 and stimulus checks. Identity theft accounted for 73 percent of these complaints, costing consumers more than $460 million. Protect yourself from these popular pandemic scams, including:

- Contact Tracing: This scheme involves criminals impersonating state health departments. Their purpose is to steal identifiable information from potential victims.

- Government agent communication: Emails or online communication sent from scammers pretending to be a government agency instructing those targeted to click on a link, submit a payment, bank info, or social security number or provide their personal identifying information.

- Fraudulent COVID Tests and Miracle Cures: Counterfeit supplements including herbal tea, essential oils, cannabinol, tinctures, and vitamins claiming to cure or prevent COVID-19 have flooded social media sites. In addition to counterfeit COVID-19 antibody tests, scammers are promoting online with the intent to steal victims’ personal information.

If you’ve been the recent target of elder abuse fraud, contact your local FBI field office or submit a tip online to file a report.